Premium banking service is all that a premium customer need and Standard Chartered Bank is one of the best premium banks in India. Standard Chartered Bank allows the customers to transact through the highly secure and accessible platform. It is not like any other private banks who do not provide much on savings accounts. SCB provides all the banking services along with premium stuff such as more reward points on platinum debit card transactions. SCB is already a developed bank, so I won’t be telling that it is all set to provide extra range of services. Standard Chartered Online Banking is one of the highly secured and convenient to use.

Internet banking is a new sensation and trend in India. Every other person is now familiar with digital banking services. Internet banking helps us to transact and use most of the banking services from our smartphone or desktop only. There is no need to visit the branch for the same. Let me tell you some of the benefits of Standard Chartered Bank internet banking.

Features:

- 24×7 access to the account information: It doesn’t matter whether you are on holiday or there is a bank holiday. Standard Chartered Bank internet banking service is available 24/7. You can access various account-related information such as your balance, transaction history, and other account details via internet banking.

- Improved security: Standard Chartered Bank is one of the premium banks of India. To provide the premium services to the customers, they do give the premium security on their protocol system as well. It is not easy to get into their portal and although the bank has fewer branches in India.

- Online credit card services: Most of the credit card services can be availed from your SCB internet banking online. You can make your credit card payments, check the history of your credit card transactions and for this, the only thing you need to do is link your SCB credit card with internet banking.

- Bill payment made easy: Before that, we need to rush to the stores and some government offices for making our bill payments, and this is because so our connection does not get stopped working. However, you can use SCB internet banking services for making bill payments online.

- Fund Transfers: There is no need to visit the bank for getting various fund transfer requests done. You can transfer the funds from your standard chartered bank to any other bank account. The only thing you need to do is add the beneficiary and post instant verification of the recipient you can start transferring funds through IMPS, NEFT, and RTGS.

- Service Requests: Most of the services request are now available to request from internet banking services. You can request a new cheque book, debit card, or credit card.

- Transaction History: Standard Chartered Bank does not provide a passbook. So, you will receive the statements via email every month at zero charges if you maintain MAB.

- Paperless Processing: Most of the services are process paperless. Like the credit card, loan approvals, etc.

We now have enough list of SCB net banking features. Now let’s come to the registration process.

SCB Net Banking Registration:

There are three methods from which you can register your Standard Chartered Bank internet banking account. All of the processes are easy to use. The ways are:

- Online Instant Self-Registration

- Offline Registration

- Registration Through IVR

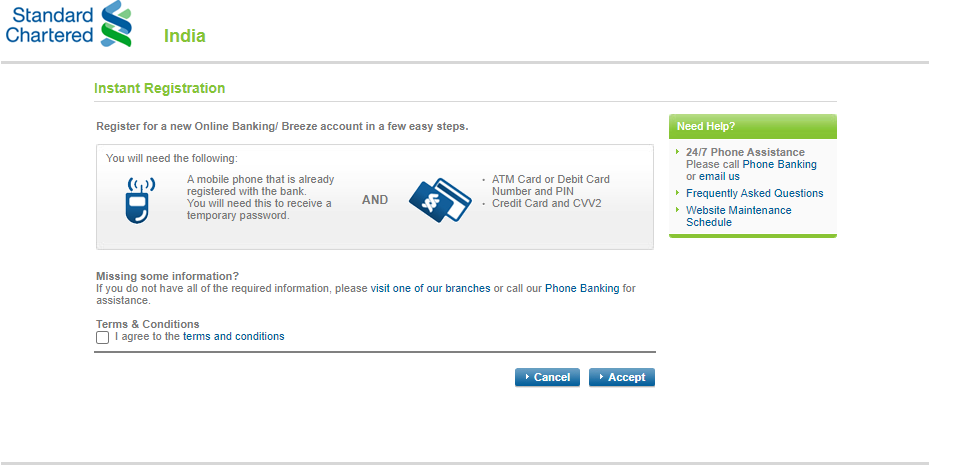

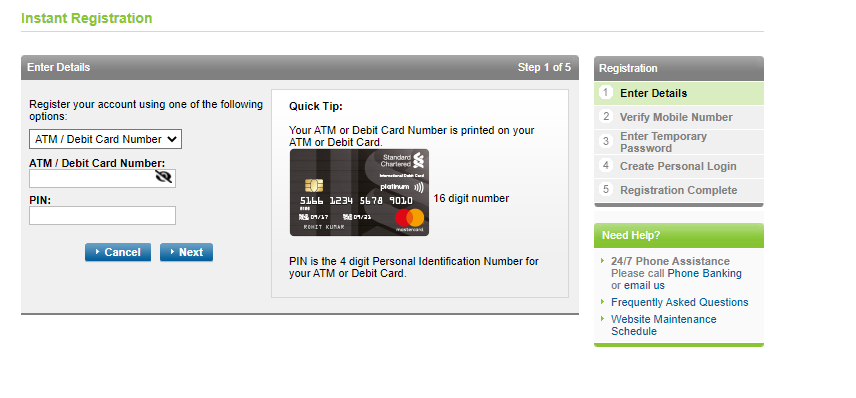

#1 Online Instant Self-Registration:

This is the most convenient way I found only if you do have the required details like the debit or credit card issued by Standard Chartered Bank and your registered mobile number.

Steps:

- First, visit the official website of SCB.

- Go through the login page.

- Click on new registration.

- Enter your customer I.D. mentioned on your cheque book and verify using a debit card and OTP from the registered mobile number.

- On the next page, create your unique login I.D. and password.

- That’s it.

#2 Offline Registration:

The second method is via offline registration. It is again the most convenient process for the customers who can give a visit to the branch for once. Let me tell you by step.

Steps:

- Visit the nearest SCB branch.

- Collect the net banking activation form and fill it.

- Submit to the branch executive of the branch.

- Post submission, the customer will receive the unique user I.D. and password on their postal address.

- After that, they can start using internet banking services from SCB bank.

#3 Registration through IVR:

The third and the option to register for Standard Chartered Bank internet banking services is via IVR. You can use phone banking for internet banking activation, and it is another convenient option for the customers.

You only need to do one thing fill the duly form and send it to the correspondence address of SCB.

Standard Chartered Bank

P.O. Box #8888

Chennai, India

Once they receive your application, they will send the user’s I.D. and password to a postal address.

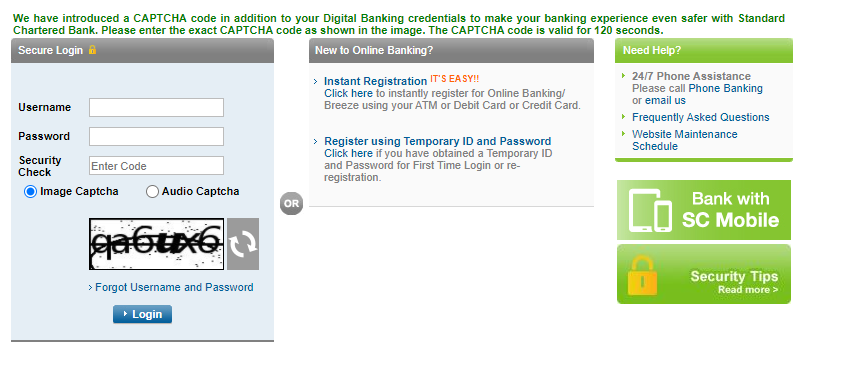

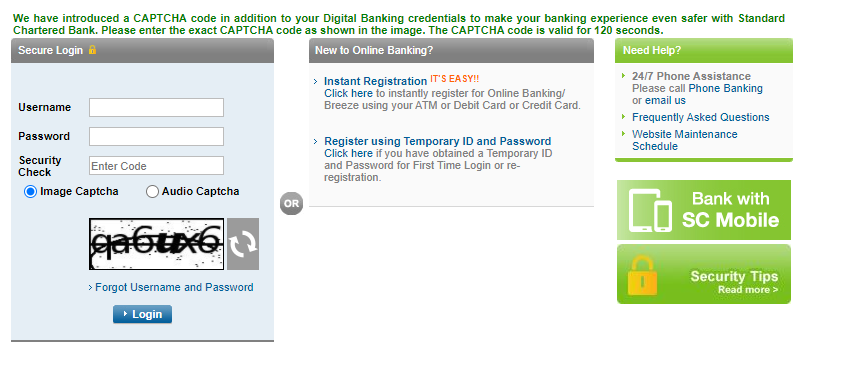

Standard Chartered Online Banking Login:

We have completed the registration process. So, now it is time for us to show you the login process. This process is for first-time users of SCB internet banking.

Steps:

- First, you need to visit the official website of the SCB net banking login page. You can visit by clicking here.

- Enter the user I.D. and password.

- Click on submit, and you will be redirected to your dashboard.

- Do not forget to log out once your work is done.

How to Reset Standard Chartered Net Banking Login Password?

There is nothing much you need to do for resetting the net banking login password. It is a quick process.

We know it happens sometimes. However, you only need to have a bit of technical and internet knowledge to reset the login password online. Alternatively, you can visit the bank for the same.

Let’s have a look at the online process.

- First, you need to visit the official Standard Chartered Bank website. You can visit by clicking here.

- From the homepage, click on the “Continue to login” button.

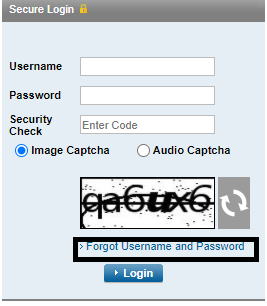

- A login page will now appear on the screen.

- After that, click on the “Forget username or password” button given below the login screen.

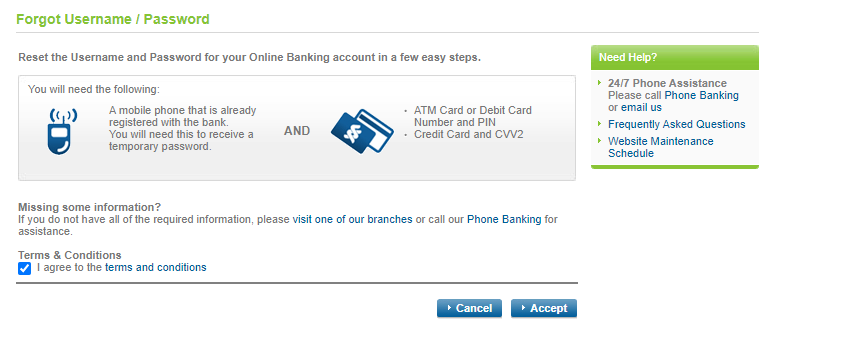

- A form will now appear on the screen.

- Agree to all the terms and conditions.

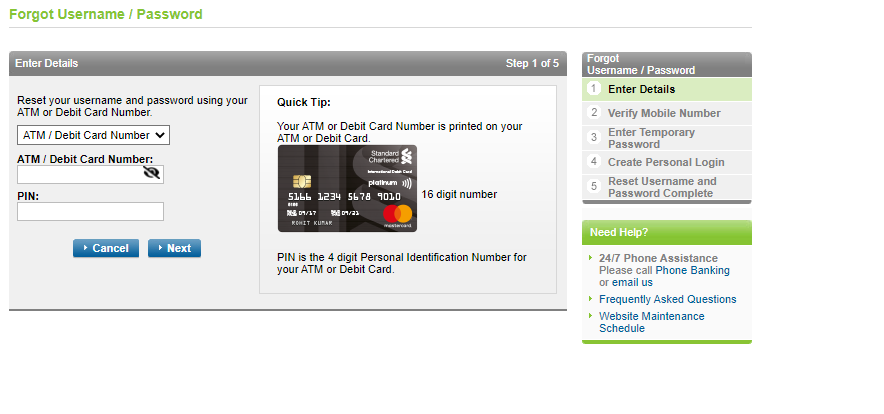

- Fill in all the required details such as the debit card and registered mobile number.

- Complete the verification using the OTP.

- You now will receive the temporary login password on the registered mobile number.

- Just use the temporary login password to get the permanent one.

Offline Process:

- First, you need to visit the nearest home branch of the Standard Chartered Bank.

- After that, you need to ask for the password regeneration form.

- Just fill in the required information in the form and submit it to the bank executive.

- Once it gets processed by the bank, you will receive the temporary login password at your postal address.

- This will take around seven to ten working days.

Standard Chartered Internet Banking Login Security Tips:

We are adding some tips for you, so in case you do not get indulged in any fraudulent activity. SCB shares these security tips. The tips are:

- You should use the trusted device to login into your internet banking account.

- You should log out from everywhere after completing your digital transaction with internet banking.

- If you think someone else has access to your internet banking account, then report to the bank and change your password.

- You should not share any confidential information like your account number, debit card, user I.D., and password with anyone.

Frequently asked questions

How to register for Standard Chartered Bank internet banking online?

One can quickly register for Standard Chartered Bank internet banking services online by visiting the official website and using the registered mobile number.

Furthermore, one can check out the detailed written steps above in this article.

How to get the internet banking registration form?

The customer can download internet banking registration form online. Alternatively, one can collect from the nearest home branch.

Furthermore, the customer can check out the detailed written steps to register for internet banking service offline above in this article.

I have forgotten my login password? What to do now to get logged in to the Standard Chartered internet banking portal?

No worries. The customer can reset the login password online using its debit card and registered mobile number. We have added a definitive guide for resetting the login password above in this article.

Does SCB (Standard Chartered Bank) charge for using internet banking service?

No, there are no charges for using internet banking services. SCB does not charge anything for this.

Can I use a smartphone for internet banking registration?

Yes, the customer can use a smartphone for internet banking registration.

Can I change my password?

Yes, the customer can change their login and transaction password any time using the internet banking facility.

How to transfer funds using SCB online banking?

It is a quick process. The customer only needs to add a beneficiary before doing any fund transfer. Once the beneficiary account gets activated, the customer can transfer the funds using IMPS/NEFT or RTGS facility using the net banking service.

Conclusion:

Standard Chartered Bank is one of the leading international banks. Standard Chartered Bank was established in 1969 in London, UK. Recently, they opened their venture in India to provide most of the global banking services to the customers. Standard Chartered Bank has more than 100 branches located in India and has access to more than 300 ATMs.

Apart from the best banking facilities, this bank is ready to comply with all the digital banking facilities, such as providing an international debit card to the customers and the internet banking services at ease. In this post, we have mentioned the same details for the registration of Standard Chartered online banking services and also added the guide for login to the same. If there are any queries left in your mind, then you can ask us in the comments section.