Organizations do not go broke because they are unprofitable. Many bankruptcies take place because the organization’s cash reserves are depleted, and they were unable to mitigate their existing repayment obligations. Any profitable organization can run out of funds because of the rising capital needs to finance their new investments for their future growth. A high working capital ratio can assist you avoid this pitfall.

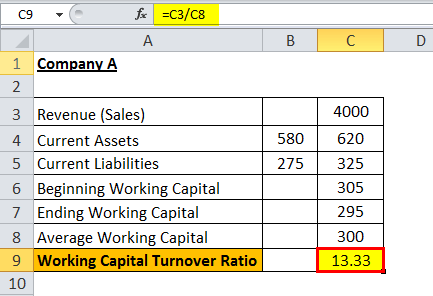

Working capital ratio = Current assets/Current liabilities

Working capital ratio on the higher end means the assets of the organization are ahead of their short-term debts. However, a lower value of working capital ratio, around 1 or below, indicates an organization may not have adequate short-term assets for repaying their short-term debts.

All organizations require working capital to fund their short-term obligations, pay their employees, suppliers, conduct mandatory daily operations etc. Working capital deficit can be met by availing working capital loan. Besides this there are other strategies to improve your working capital ratio.

- Manage your inventory efficiently

By increasing your business efficiency, you can ameliorate your working capital ratio. Note that current assets include assets and liquidity that soon can become liquid. Racking up inventory may enhance your storage expenses. Even if the expense is minimal, there is another issue. Your liquidity is racked up in storage. Devising a plan for your inventory for its quick movement will enhance your working capital ratio. You may consider auditing all your supply processes as a solution.

- Detect unnecessary expenses

Higher your liabilities, lower will be your working capital ratio. Any reduction in your liabilities can improve your working capital ratio as long as your current assets stay constant or increase. Note that the second part is crucial as any reckless deduction in your budget can create a negative impact on your working capital.

Closely watch your budget and derive a sense of which activities are major for running your organization and which ones are not necessarily making any contribution to your revenue. While reducing unnecessary liabilities may not add up much to your savings in aggregate, they might show a noticeable difference in your ratio.

- Collect all invoice payments within time

Your invoices might represent the promise your customer makes to pay. However, at times they may remain unpaid for a long time-period. While unpaid invoices might be factored into your current asset, this does not make sense if they are not liquid.

So, how can you collect your payment within time? One of the best ways is if you incentivize repayments. You can either opt for a stick or carrot approach. For instance, you can offer perks or future discounts to customers that make their invoice repayments on time. Alternatively, late payment fees can be charged on overdue invoices. Choice is yours to experiment with your policies to understand to which approach your customers respond better. You may even consider a combination of both approaches.

Ending note

By now, you must have gotten an idea that your working capital ratio indicates a fair estimate of your organization’s financial health. And it is something you can improve by adopting the above listed strategies.

Krishna Murthy is the senior publisher at Trickyfinance. Krishna Murthy was one of the brilliant students during his college days. He completed his education in MBA (Master of Business Administration), and he is currently managing the all workload for sharing the best banking information over the internet. The main purpose of starting Tricky Finance is to provide all the precious information related to businesses and the banks to his readers.