Commercial real estate fundraising is something that is constantly evolving and in a state of flux. This is because fundraising in real estate projects is massively impacted by macroeconomic factors across the world.

When the global economic situation is poor, fundraising tends to slow and when there’s confidence in the markets, funding opportunities will increase. Given the current volatile economic situation globally, there are a lot of questions about the trajectory of fundraising in real estate.

Despite these factors, there are still an array of great opportunities for fundraising and investment in the commercial real estate market. With potential gains for investors still being huge overall.

Technological Solutions For Fundraising

Finding fundraising opportunities can be incredibly difficult in the current market, particularly for LPs in real estate. As a result of this, more emphasis is being placed on technological solutions for commercial real estate fundraising. These solutions focus on using digital technology to help people running projects to market their opportunities to potential investors and manage their investors. For example, collecting signatures and payments can be achieved through these types of platforms. Overall, real estate professionals are finding a lot of success with these platforms despite the overall funding slowdown.

The Rise of Property Crowdfunding

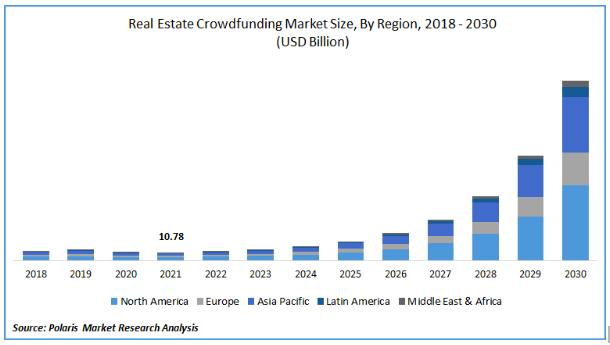

Due to the difficulties in finding institutional investors for real estate projects, there has been a rapid increase in the amount of projects being funded by crowdfunding. In fact, the size of the market for real estate crowdfunding in 2022 reached $10.8 Billion and is projected to rise to $250 Billion in 2030. This highlights the rapid potential growth in the market and it’s likely that more and more projects are going to be funded by average people using crowdfunding.

Indeed, one of the biggest drivers of crowdfunding in real estate is the fact that many people that want to get on the property ladder can’t afford a full property, so they’ll turn to crowdfunding and take a share of a property to build their portfolio up over time.

The Lingering Impact of COVID

It’s been a long time since we have felt the full impacts of the COVID-19 pandemic, however some of the changes that have come from the virus are still prevalent in the market.

For example, many companies are still offering hybrid and remote working, which has kept the demand for commercial real estate such as office blocks slightly lower than normal, with vacancies in these types of buildings being at 15.4% in the third quarter of 2022. It’s unclear if this trend will be maintained or if things will return to normal, with vacancies being reduced.

The Fundraising Slowdown

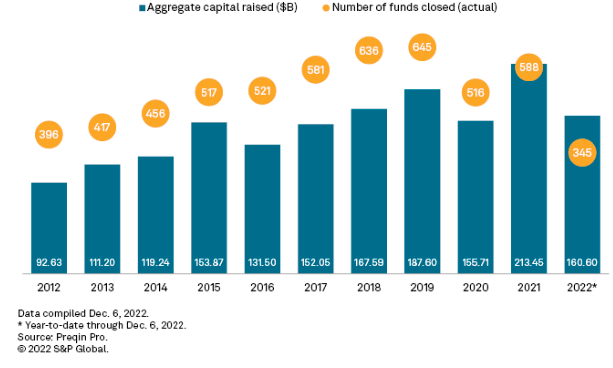

Fundraising in the property market has exploded in recent years, leading to a lot of funding floating around for projects. Unfortunately, during 2022 funding slowed significantly and currently, more than half of respondents to a recent survey have stated that they are either uncertain or pessimistic about the potential opportunities for deals in the market.

This is largely in response to economic factors such as rising interest rates and global supply chain issues. Despite this, the long-term outlook seems more positive overall.

As a direct result of this, investors are looking more at off-market deals and opportunities for distressed assets or restructuring. It’s likely that a more opportunistic strategy will be seen across the general market in response to these factors.

What Investments Are Still Attractive?

The flavour of the day in terms of investment for real estate can rapidly change depending on the investor’s appetite for risk. As it stands, reports have shown that some of the most attractive asset classes are distribution centres, grocery-based retail outlets, luxury hotels, ESG-compliant office properties. This is because these assets are generally considered to be safer than other asset classes.

As has been highlighted through this post, you can see that the current environment for fundraising of commercial real estate presents a number of challenges both for investors and property owners alike. Due to these difficulties, greater emphasis is being placed on crowdfunding for commercial property investments and technological solutions to drive investments. Despite the difficulties in the market, it’s likely that these will stabilise throughout the year as constraints around interest rates and global supply chains stabilise.

Krishna Murthy is the senior publisher at Trickyfinance. Krishna Murthy was one of the brilliant students during his college days. He completed his education in MBA (Master of Business Administration), and he is currently managing the all workload for sharing the best banking information over the internet. The main purpose of starting Tricky Finance is to provide all the precious information related to businesses and the banks to his readers.