You must come across this article looking for detailed information about Dow Jones Live Chart. Luckily, you have landed in the right place. Dow Jones, or simply Dow is a price-weighted measurement stock market index of the thirty prominent companies. This is often known as DJIS (Dow Jones Industrial Average).

It is one of the oldest and the commonly followed indices. Most people consider Dow Jones to be an inadequate representation of the overall Stock Market Exchange. The DJIS include only 30 companies, which is due to the lower number of American stocks.

However, this article is created for providing life information about Dow Jones Live Chart and its share price index. Let’s have a look at further information in this article.

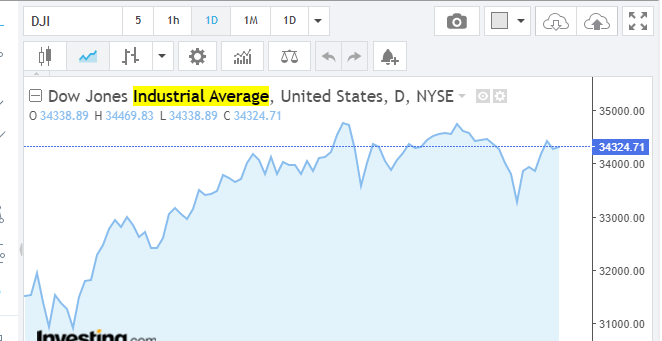

Dow Jones Live Chart

You must have encountered this article looking for these live updates. We will be updating this article along with major changes that happen to the price index of Dow Jones.

For instance, the current share price and live charts show USD 34375.08

You will keep getting updates regarding the Dow Jones Live Chart in this section. If we talk about the downfall of this share price, then recently on 18 June 2021, the share price was 33000 USD. Let’s have a look at its Wiki Profile.

Wiki Profile – Dow Jones

- Website – https://us.spindices.com/indices/equity/dow-jones-industrial-average

- Headquarters – New York, NY

- Trading Symbol – DJI^

- Founded – February 16, 1885

- Companies Listed – 30

- Operators – S&P

Dow Jones Index

Before coming into the future part, we need to make sure and read about the beginning and current index of Dow Jones. It is not a kind of small share that could be easily taken. For instance, it is one of the world most prestigious stock indexes. This provides a shorthand way of gauging the daily markets into the US stocks.

More importantly, the performance for the underlying components would be evident in 30 chip companies. This is the primary reason why one needs to understand the working process of the Dow Jones Index.

The Dow Jones Index is commonly known as the cash market. This is often get reported every day. The reason why it gets referred to as the cash market is only because of its density and the things that differentiate the index from its future market index.

In simple words, it gets called ‘Cash Market.’ The reason is quite simple as the cash gets exchanged for purchasing varieties of stocks.

Trading?

As we have mentioned earlier in this article, if one wants to trade Dow Jones then one often needs to fix a continuous eye on both Dow Jones live charts. The one chart itself predict the future, and the other one is for showing the current live index chart.

Before we continue the next explanation, let me mention it. The future index only controls the cash market and is often subject to market risk. You cannot predict the exact date, the amount for a share price. We will explain all the things in this article but as for now, let’s have a focus on its index.

Dow Jones Index Explained

The Dow Jones Index was originally compiled by Charles Dow. He is a financial journalist who has created DJIA (Dow Jones Industrial Average) in 1896. This share generally started its journey with 12 of the largest US Stocks. The name was created suggest towards to measure the growth and performance in equities factor in the manufacturing and industrial sector.

Fact, it has started its journey in 1882, but originally it comes into the performance and published in wall Street of the journal in 1896. The index generally gets calculated by adding all the stock share prices and companies index, then, later on, dividing by 12. In particular one split? There was a problem with share calculation. Since the number one or two will double the number of shares. Hence it would get difficult to calculate using the simple given method.

During the early years, it was not even a problem. It is because the stock splits were rare. But, the increase in demand and technology enhances and increases the work.

Companies?

In 1916, eight new companies were added to the Dow Jones Index. Later on, ten more companies joined this index. This now consists of a total of 30 companies that is currently under the Dow Jones Live Chart and its Index.

Let’s come to its future.

You may also like to read, Investing In Peer-To-Peer Lending: 7 Pros And Cons

Dow Jones Future Index

A warm welcome to everyone in this section. We have already mentioned every other information regarding Dow Jones, its live charts and its index. You now have all the required information to confirm the study case. Thus, let’s talk about the future index of Dow Jones.

Dow Jones Industrial Average (DJIA) is one of the world’s most recognized and watched indices. This generally tracks the performance of US markets on the daily basis.

Once you are finished reading this article, you will be having a good understanding and knowledge about Dow Jones Live Chart, Index and its future index. You will even know the trading part.

You should understand the term ‘Money is everywhere, just one needs to take the risk.’ You cannot just become a millionaire overnight if you do not intend to take the risk. However, it does not mean that one should invest in any stocks blindly without even reading about the company information and its future development.

Honestly, there is a difference between being smart and being blind. In this case, one needs to be smart before taking any risk and investing in DJIA. You can start by investing in less volatile shares. This will lessen the chances of risk and more the chances of returning investment with some profit.

My Story?

If I tell the people about me? Then, when I have started trading, there was no option to trade electronically. Meanwhile, I have to visit the stock market exchange to put my funds and convert my cash into stocks. At the time I was having a lessen experience in stock market tradings.

But, we even say? You need to learn enough before working in a particular field. I learnt and researched enough information about the share and the company along with prospects. Thus, I have invested and converted cash into stocks.

Remember, the stock market is versatile. You can make the money fast and even lose all the cash in the market within a few minutes. You need to be real smart before investing the funds into the stock market.

What is the Dow Jones Industrial Average?

DJIA (Dow Jones Industrial Average) is one of the oldest and the commonly followed indices. Most people consider Dow Jones to be an inadequate representation of the overall Stock Market Exchange. The DJIS include only 30 companies.

You even heard some people talking about the Dow moves by 80 points in the market. It does mean the news anchor is talking about Dow Jones Industrial Average. For instance, the Dow is the average price of the stocks listed in the selected group of stocks under DJIA.

In simple words, it a single company performance, an index that helps the investor to check and keep up the records for the overall performance of the company.

When the DJIA get started, it only included 12 companies. But as of now, the DJIA has listed a total of 30 companies. The 30 companies are selected because they have been considered market-leading companies in the market.

Companies Listed;

- 3M

- American Express

- Amgen

- Apple INC.

- Boeing

- Catterpiller Inc.

- Chevron Corporation.

- Cisco Systems.

- The Coca-Cola Company

- Dow Inc.

- Goldman Sachs

- The Home Depot

- Honeywell

- IBM

- Intel

- Johnson and Johnson

- JPMorgan Chase

- McDonald’s

- Merck & Co.

- Microsoft

- Nike Inc.

- Procter and Gamble.

- Salesforce

- The Travellers Company.

- UnitedHealth Group.

- Verizon Communications.

- Visa Inc.

- Walgreens Boots Alliance.

- Walmart

- Walt Disney Company.

Investment Methods;

Investment in DJIA is possible using index funds. You can even invest using optional contracts and futures contracts.

- Mutual and Exchange-traded funds: The easiest and quick way to invest in DJIA is by purchasing the index funds from the market and directly investing in the Dow Jones Industrial Average Stock.

- Future Contracts: In the derivatives market, the CME group issues future contracts through its subsidiaries Chicago Mercantile Exchange (CME) and the Chicago Board of Trade (CBOT). This track the average and trade on the floors.

- Options Contracts: The Chicago Board Options Exchange (CBOE) issues the options contracts through the DJX. Thus, it gets available for trading.

The Bottom Line

DJIA (Dow Jones Industrial Average) is one of the oldest and the most commonly followed indices. It started its journey in 1882, but originally it came into the performance and published in Wall Street the journal in 1896. The DJIS includes only 30 companies, which is due to the lower number of American stocks.

The companies listed in the DJIA are well-formed and organised. However, the motive of adding this article over here is to let people be aware of the Dow Jones Live Chart and its share price index.

For instance, we have added everything that one needs to know about it. If there is anything else to ask? You can ask us in the comments section.

Krishna Murthy is the senior publisher at Trickyfinance. Krishna Murthy was one of the brilliant students during his college days. He completed his education in MBA (Master of Business Administration), and he is currently managing the all workload for sharing the best banking information over the internet. The main purpose of starting Tricky Finance is to provide all the precious information related to businesses and the banks to his readers.